Mortgage reduction calculator

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. For example if you want to make an extra monthly payment of 100 during months 1-9.

Mortgage Repayment Calculator

The calculator will not recognize overlapping payments of the same frequency.

. Mortgage Discount Points Calculator. Mortgage Payoff Calculator 2a Extra Monthly Payments. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

Interest savings and reduction in length of loan are calculated. Home financial va mortgage calculator. Other times the reduction.

Using our mortgage rate calculator with PMI taxes and insurance. The Debt Payoff Calculator uses this method and in the results it orders debts from top to bottom starting with the highest interest rates first. Mortgage calculator with graphs amortization tables overpayments and PMI.

See how those payments break down over your loan term with our amortization calculator. Amortization is the process of paying off a debt with a known repayment term in regular installments over time. Eight calcs for all your mortgage sums.

Extra payments count even after 5 or 7 years into the loan term. Qualified homeowners receive the money as a zero percent interest forgivable loan that comes with certain guidelines if you qualify. Mortgage insurance is required for all home purchases with down payments less than 20 of a propertys value.

Another program is the Principal Reduction Program that can help homeowners with up to 50000 to reduce the loan-to-value ratio. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Mortgages with fixed repayment terms of up to 30 years sometimes more are fully-amortizing loans even if they have adjustable rates.

Reduction PMI payment Remaining Balance Interest calculated at 112th of annual interest rate on the remaining principal amount. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. By paying a little extra on principal each month you will pay off the loan sooner and reduce the term of your loan.

Half of all households in the province experienced income reduction due to the. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest.

In other words a credit card with an 18 interest rate will receive priority over a 5 mortgage or 12 personal loan regardless of the balance due for each. Ultimately significant principal reduction cuts years off your mortgage term. Refinancing is not the only way to decrease the term of your mortgage.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. The mortgage amortization schedule shows how much in principal and interest is paid over time. CMHC mortgage insurance calculator.

For example a 30-year fixed-rate loan has a term of 30 years. The Loan term is the period of time during which a loan must be repaid. MORTGAGE TERM REDUCTION TOTAL INTEREST SAVED OVERPAYING A 150K MORTGAGE AT 3 1 INTEREST IF YOU SAVED THE OVERPAYMENT AT 2 2 10.

For example adding 50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than 27000 in interest costs. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Show all Show less.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. This Private Mortgage Insurance PMI calculator reveals monthly PMI costs the date the PMI policy will cancel and produces an amortization schedule for your mortgage. This calculator makes it easy for home buyers to decide if it makes sense to buy discount points to lower the interest rate on their mortgage.

If I make a principal reduction payment in the future am I eligible to recast my loan again. Then enter the loan term which defaults to 30 years. The exact amount that your interest rate is reduced depends on the lender the type of loan and the overall mortgage market.

Sometimes you may receive a relatively large reduction in your interest rate for each point paid. For example a 30-year fixed-rate loan has a term of 30 years. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type.

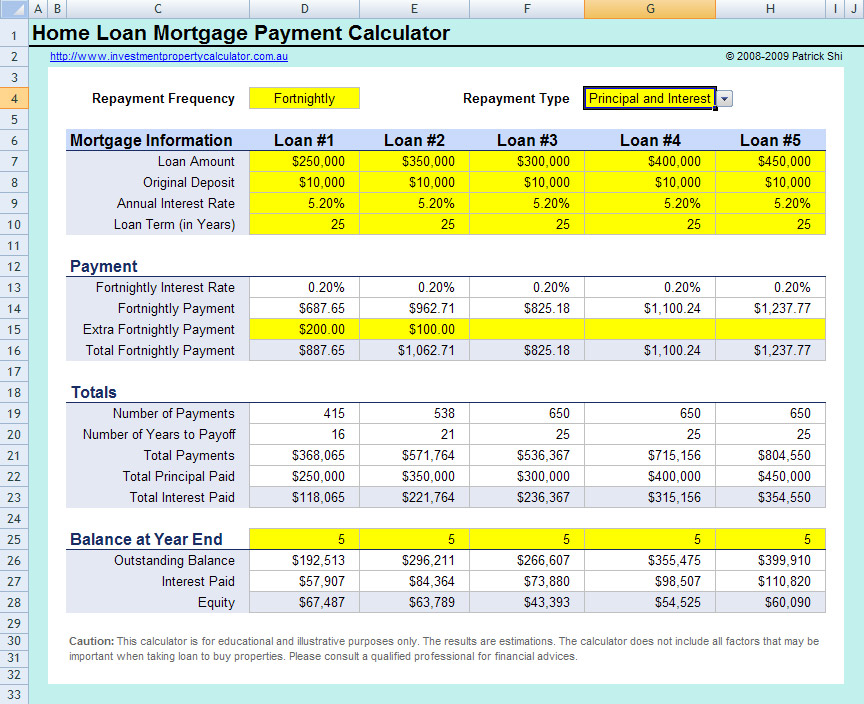

Yes if you pay down the principal balance ahead of schedule you will be eligible to recast your loan again. The insurance protects mortgage lenders should the borrower be unable to make payments and default on the mortgage. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side.

A good monthly home mortgage calculator tells individuals not only if they can afford a selected home but what kind of factors might influence future payments. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. If the first few years have passed its still better to keep making extra payments.

The Loan term is the period of time during which a loan must be repaid. While the maximum affordable mortgage. Lets say you have a 220000 30-year mortgage with a 4 interest rate.

Interest Rate Reduction Refinancing Loans. 050 Also called IRRRL they can be used to lower interest rates by refinancing existing VA loans. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. Who This Calculator is For. This Excel spreadsheet is an all-in-one home mortgage calculatorIt lets you analyze a fixed or variable rate home mortgage.

You can set up periodic extra payments or add additional payments manually within the Payment ScheduleUse the spreadsheet to compare different term lengths rates loan amounts and the savings from making extra. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. Estimating your monthly payment with our mortgage calculator or looking to prequalify for a mortgage we can help you at any part of the.

It calculates how many months it will take for the discount points to pay for themselves along with the monthly loan payments and net interest savings. Two years four months. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA.

Free VA mortgage calculator to find the monthly payment total interest funding fee and amortization details of a VA loan or to learn more about VA loans. Another technique is to make mortgage payments every two weeks.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Payoff Calculator With Line Of Credit

House Loan Repayment Calculator Discount 55 Off Www Ingeniovirtual Com

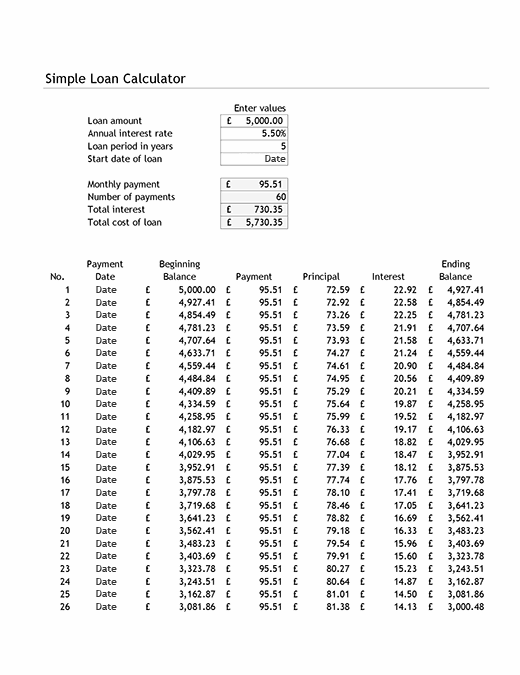

Simple Loan Calculator And Amortisation Table

Simple Mortgage Calculator

Extra Payment Mortgage Calculator For Excel

Mortgage With Extra Payments Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Excel Formula Estimate Mortgage Payment Exceljet

Loan Repayment Calculator

The Best Mortgage Repayment Calculator Out There Mortgage Repayment Calculator Refinancing Mortgage Repayment

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Downloadable Free Mortgage Calculator Tool

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Free Interest Only Loan Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template