22+ Unadjusted Cost Of Goods Sold Is Calculated By Subtracting ______.

Web Cost of goods sold is calculated by first adding the cost of. Cost of Goods SoldWhat is adjusted cost of goods soldWhat is the Adjusted Cost.

Fabm Sci Quiz 4 Pdf Cost Of Goods Sold Net Income

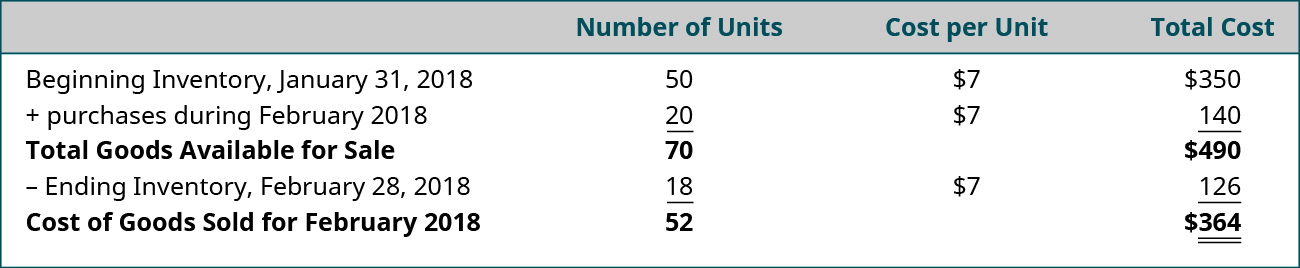

Cost of goods sold is calculated by first adding the cost of purchased or manufactured inventory to the cost of beginning inventory for the specified period and then subtracting the.

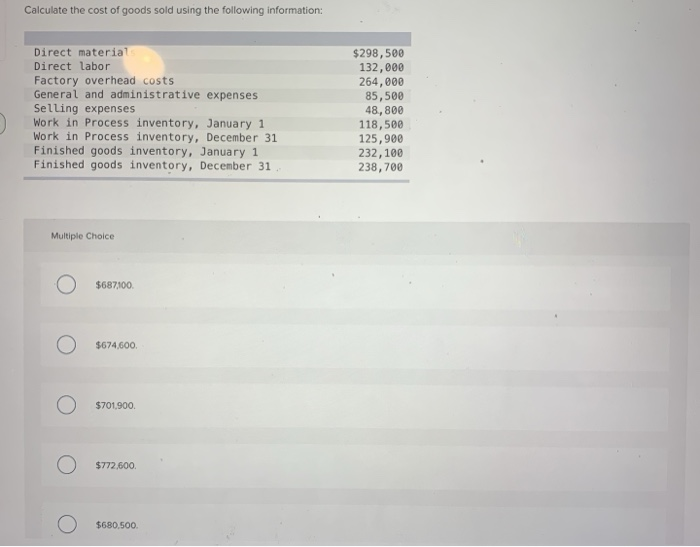

. Cost of good sold and Accounts Receivable Total manufacturing costs formula. To do this subtract the cost of goods sold from your. Cost of goods sold is the sum of all costs including sales and.

Ending Inventory of Finished Goods. Assume the variance calculated is material. Subtract cost of goods sold from revenue to determine gross profit.

Subtract the cost of goods sold total from the revenue total on your income statement. Use the Cost of Goods Sold Calculator to calculate the direct costs related to the production of the goods sold in a company. Calculate your cost of goods sold and subtract the amount from your inventory.

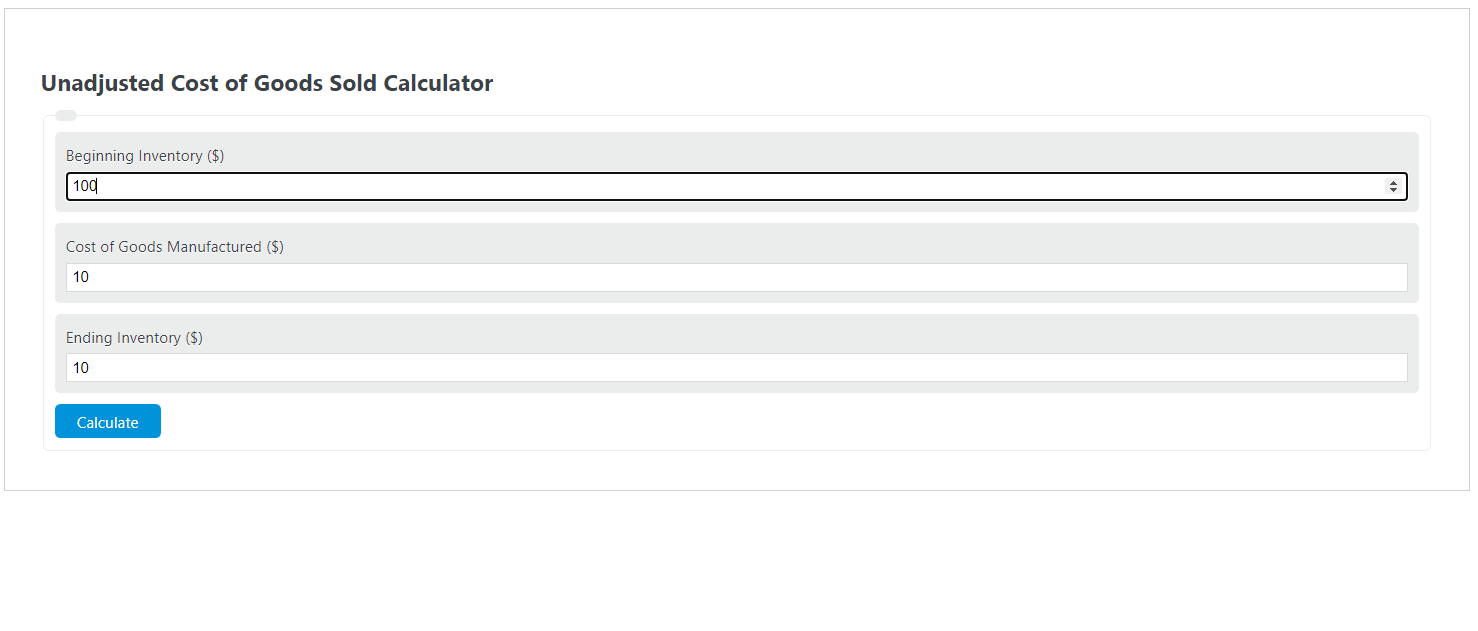

The unadjusted cost of goods sold only includes the manufacturing or production costs for a period. The unadjusted cost of goods sold is the price a company pays for a particular itemserviceproduct. DM DL MOH applied To calculate direct materials on the schedule of cost of goods manufactured.

Subtract the cost of goods sold total from the revenue total on your income statement. 20000 Now if your revenue for the year was 55000 you could calculate your gross profit. We own a clothing store and we have a beginning inventory of 100000 last month.

Subtract the cost of goods sold from the total revenues to calculate the companys gross profit. Hence Cost of Goods Sold can be calculated as. Unadjusted cost of goods sold is calculated by subtractingceladon pottery facts oliver packaging and equipment Menu principale 5858 dryden place carlsbad ca 92008.

The adjusted cost of goods sold Subtract. Web The unadjusted cost of goods sold includes various items. Purchases during the month were 50000.

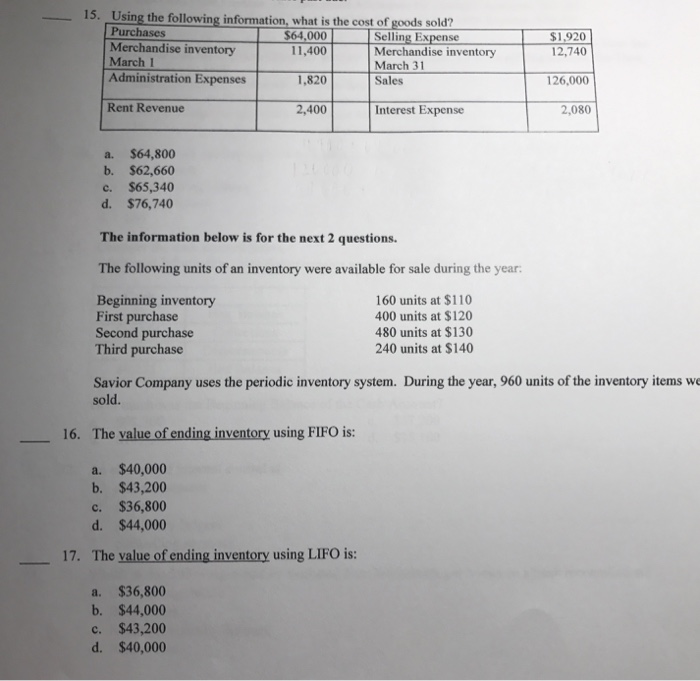

The purchases of stock in trade were Rs 6000 Cr. Cost of goods sold. Calculate the cost of goods sold expense if the company uses the average cost inventory valuation method.

However they fail to consider the impact of the inventory changes for that period. This question hasnt been solved yet. Cost of Goods Sold Beginning Inventory Purchases during the year Ending.

Web The adjusted cost of goods sold Subtract. Last month was a pretty good. Calculate the cost of goods sold expense.

This includes the material costs used creating the.

Fabm Sci Quiz 4 Pdf Cost Of Goods Sold Net Income

Accounting Quiz 3 Chpt 6 8 Flashcards Quizlet

Cost Of Goods Sold Problems And Solutions

Fabm Sci Quiz 4 Pdf Cost Of Goods Sold Net Income

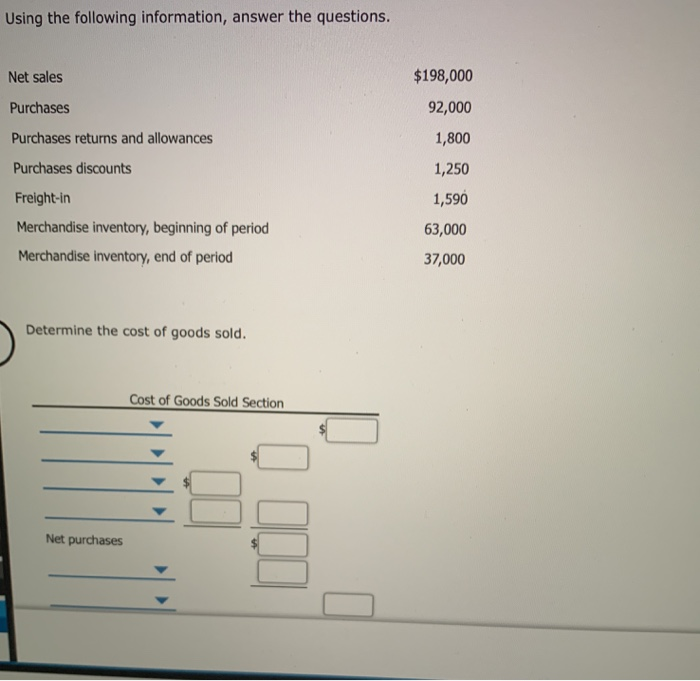

Solved Using The Following Information Answer The Chegg Com

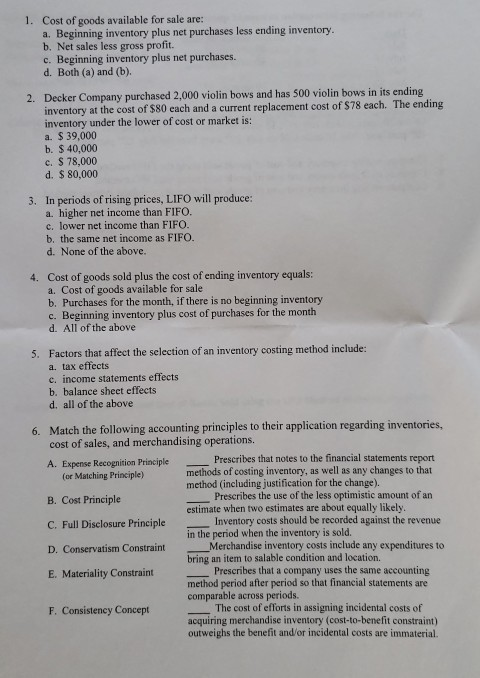

Solved 1 Cost Of Goods Available For Sale Are A Beginning Chegg Com

Acct202 Exam 1 Flashcards Quizlet

Chapter 8 Inventories And The Cost Of Goods Sold

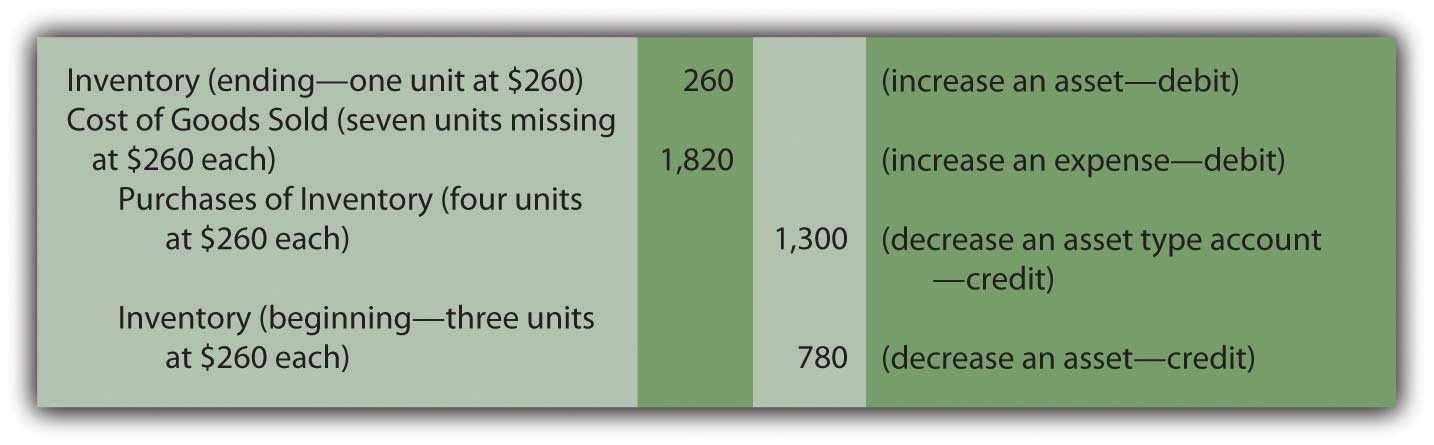

2 6 Accounting For Inventory Financial And Managerial Accounting

Solved 15 Using The Following Information What Is The Cost Chegg Com

Solved Cost Of Goods Sold Can Be Calculated M The Following Chegg Com

Fabm Sci Quiz 4 Pdf Cost Of Goods Sold Net Income

Unadjusted Cost Of Goods Sold Calculator Calculator Academy

Solved Calculate The Cost Of Goods Sold Using The Following Chegg Com

Solved Exercise 6 9 Hamid S Hardware Reported Cost Of Goods Chegg Com

The Calculation Of Cost Of Goods Sold

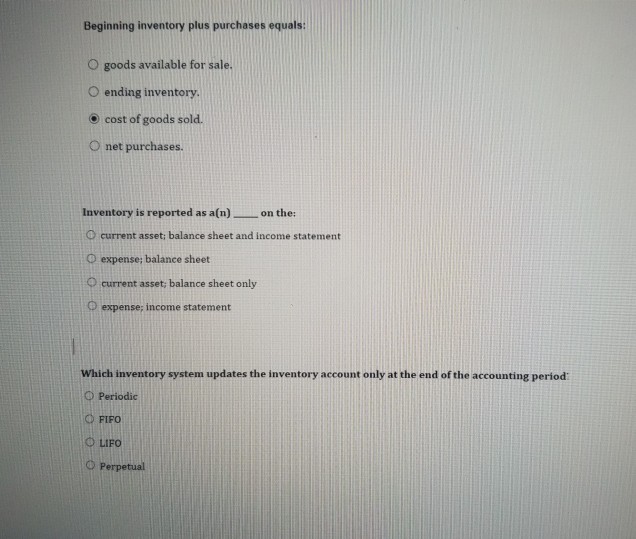

Solved Beginning Inventory Plus Purchases Equals O Goods Chegg Com